Corporate Governance

AssetsVista Code of Business Conduct and Ethics sets high standards of integrity and ethics for all directors, officers and employees of the company and its subsidiaries.

Providing institutional independence

An effective structure is in place providing for cooperation between the Board of Directors of AssetsVista Insurance Group Ltd, management and internal control functions. This structure establishes checks and balances and is designed to provide for institutional independence of the Board from the Group Chief Executive Officer (Group CEO) and the Executive Committee (ExCo) which together are responsible for managing the Group on a day-to-day basis. The Board of Directors of AssetsVista Insurance Group Ltd is composed entirely of independent non-executive members. The roles of Chairman of the Board of Directors and CEO are separated, thus providing for separation of powers between the functions and ensuring the autonomy of the Board.

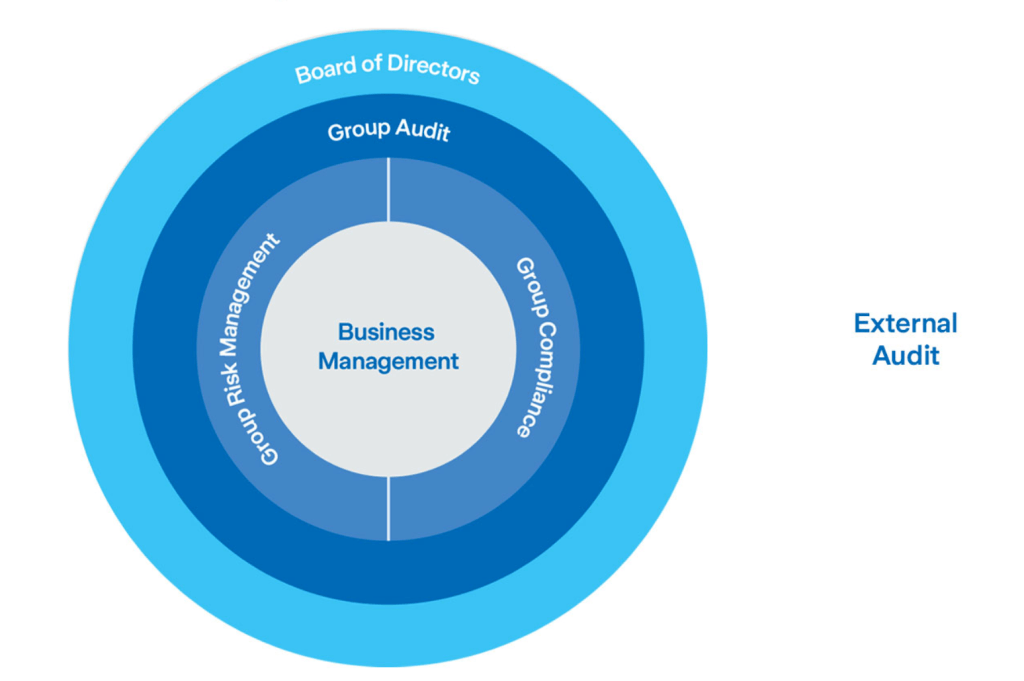

Three lines of Defense at AssetsVista Insurance Group

as of December 31, 2020

AssetsVista uses the three-lines-of-defense model in its approach to governance and enterprise risk management. AssetsVista’s three-lines-of-defense approach runs through AssetsVista’s governance structure, so that risks are clearly identified, assessed, owned, managed and monitored.

1st line: Business Management

The first line of defense consists of business management and all functions except Group Risk Management, Group Compliance and Group Audit. The first line takes risks and is responsible for day-to-day risk management (i.e. risks are identified and monitored, mitigation actions are implemented and internal controls are in place and operating effectively).

2nd line: Group Risk Management and Group Compliance

The second line of defense consists of the two control functions, Group Risk Management and Group Compliance. Group Risk Management is responsible for AssetsVista’s enterprise risk management framework. The Group CRO regularly reports risk matters to the Group CEO, senior management committees and the Risk and Investment Committee of the Board.

Group Compliance is responsible for providing assurance to management that compliance risks within its mandate are appropriately identified and managed. The Group Chief Compliance Officer regularly provides reports to the Audit Committee and has an additional reporting line to the Chairman of the Audit Committee and appropriate access to the Chairman of the Board.

3rd line: Group Audit

The third line of defense consists of the assurance function Group Audit. Group Audit is responsible for auditing risk management, control and governance processes. The Head of Group Audit reports functionally to the Chairman of the Audit Committee and administratively to the Group CEO, and meets regularly with the Chairman of the Board and the Chairman of the Audit Committee and attends each meeting of the Audit Committee.

Board

The Board is ultimately responsible for the supervision of the control and assurance activities.

External audit

External audit is responsible for auditing the Group’s financial statements and for auditing AssetsVista’s compliance with specific regulatory requirements. The Audit Committee regularly meets with the external auditors.

The roles of the Board Committees:

The Board may establish committees for specific topics, terms of reference and rules with respect to delegated tasks, responsibilities and reporting to the Board. Except for the Remuneration Committee, the Board constitutes such committees from among its members at its own discretion. The members of the Remuneration Committee are elected by the shareholders’ meeting. The committees assist the Board in performing its duties. They discuss and propose matters to the Board in order that it may take appropriate actions and pass resolutions unless they are authorized to take resolutions in specific areas on their own

Standing committees

Board has the following standing committees, which regularly report to the Board and submit proposals for resolutions to the Board.

Governance, Nominations & Sustainability Committee

Remuneration Committee

Audit Committee

Risk and Investment Committee

Key tasks and responsibilities:

Supports the Board, in line with the Group’s commitment to good corporate governance, sustainable business conduct and value creation, by establishing best practices in corporate governance across the Group with a view to ensuring that the shareholders’ and other important stakeholders’ rights are fully protected.

Assists the Board in setting an appropriate tone at the top to promote key values and behaviors, and to ensure a sound and open culture throughout the organization.

Develops and proposes guidelines to the Board for corporate governance and reviews them.

Ensures compliance with corporate governance disclosure requirements and legal and regulatory requirements is entrusted with succession planning for the Board, the Group CEO and members of the ExCo.

It makes proposals to the Board on the composition of the Board, the appointment of the Chairman, the Vice-Chairman, the Group CEO and members of the ExCo. Final decisions for nominations and appointments are made by the Board, subject to shareholder approval, where required. When identifying and proposing candidates as new Board members, preserving and increasing the Board’s diversity is a key consideration. Apart from specific qualifications, every candidate should possess integrity, be of good standing, and be capable and available to fulfill his or her duty of care by serving, in close collaboration with the other Board members, the best interests of the Group’s stakeholders (see Nomination Principles in article 15 ff. of the Annex to the Organizational Rules under Corporate documents

reviews the system for management development and supervises progress made in succession planning.

Reviews and proposes to the Board for approval the Group’s sustainability strategy and objectives, including targets having a material impact on the Group.